Pay Less Tax Newsletter – Winter 2026 Edition

Read the Winter 2026 Pay Less Tax newsletter from Sibbalds. HMRC crypto enforcement, executors’ responsibilities, PAYE Settlement Agreements, and tax year-end planning.

Monthly Tax Update – January 2026

Our January Tax News roundup highlights key developments including Making Tax Digital for Income Tax, payrolling benefits in kind, e-invoicing, VAT updates and important deadlines.

Monthly Business News: January 2026

Our January Business News reflects on current economic conditions and the questions many business owners are considering as they set priorities, build resilience and plan for the year ahead.

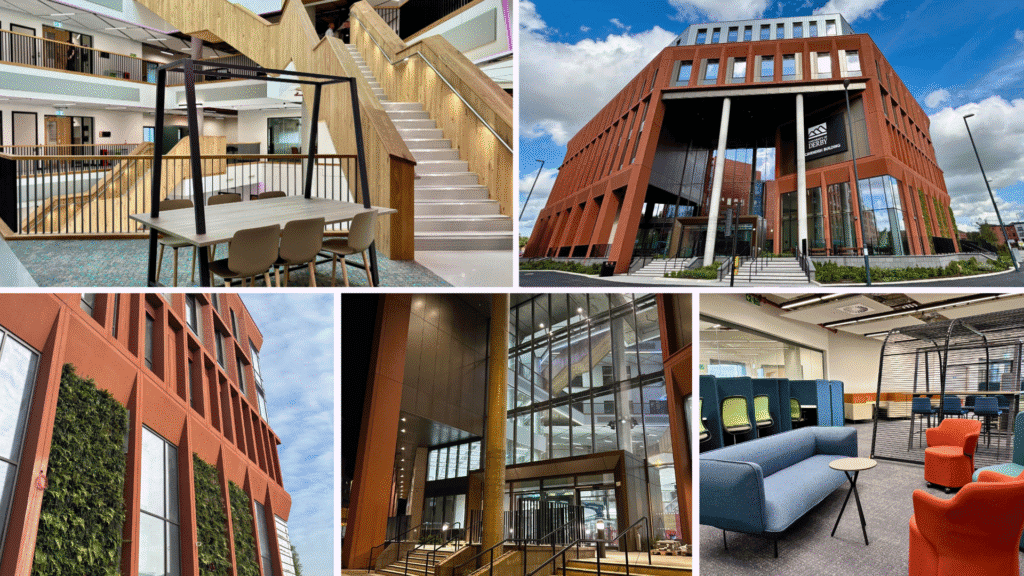

A New Chapter for Sibbalds: Rebrand, Website Launch and Office Move

We’re entering a new era at Sibbalds with a refreshed brand, a brand-new website, and an exciting move to our new home at the University of Derby’s Business School.

Autumn Budget 2025 – What the Key Announcements Mean for You

Chancellor Rachel Reeves has delivered the Autumn Budget, outlining a wide range of changes that affect individuals, businesses and landlords. Here’s a clear summary of the most important updates and what they could mean for you.

Pay Less Tax Newsletter – Autumn 2025 Edition

Discover the latest tax-saving insights in our Autumn 2025 newsletter: CGT-free exits, FHL changes, pre-Budget planning, and Covid support amnesty.

Pay Less Tax Newsletter – Summer 2025 Edition

In our Summer 2025 Pay Less Tax newsletter, explore salary sacrifice, share schemes, MVLs and tax relief on professional subscriptions.

Pay Less Tax Newsletter – Making Tax Digital 2025 Edition

New tax year changes, planning tips, and strategies to minimise your liabilities.

Pay Less Tax Newsletter – Winter 2025 Edition

Important tax changes are coming in 2025—discover key strategies to reduce your tax bill and maximise savings in our latest Pay Less Tax newsletter

Pay Less Tax Newsletter – Autumn 2024 Edition

In this Autumn edition of the Pay Less Tax newsletter, we explore these key topics: Growth Guarantee Scheme (GGS): Director Loans – Section 455 Charges: Foster Carers – Tax Relief: LLP Salaried Member Rules:

Pay Less Tax Newsletter -2024 Vehicle Special Edition

Navigating the ever-changing landscape of vehicle taxation can be challenging for businesses. Our latest 2024 Vehicle Special newsletter covers important topics such as Clean Air Zone Charges (CAZC), the implications of the VAT Margin Scheme (VMS) for second-hand vehicle dealers, and the upcoming changes to double cab pickup (DCPU) tax treatment. Key Highlights Include: Stay informed to…

Summary of the tax announcements in the Autumn 2024 Budget

On 30 October 2024, Chancellor Rachel Reeves presented her first budget to parliament. This was a budget intended to restore stability to our economy and to begin a decade of national renewal. Investment will be funded by revised debt rules to facilitate additional borrowing and a hefty £40 billion of tax rises. Headlines included: In…

Sibbalds’ 2024 Team Away Day at Bear Grylls Adventure

On Friday 20th September, Sibbalds took to Bear Grylls Adventure at Birmingham Resorts World for our long-awaited away day as a result of achieving our internal targets for the 2024 financial year. On arrival we were all presented with some new Sibbalds merchandise including hoodies, notebooks and pens, which you may be able to spot…

Pay Less Tax – Summer 2024 Edition

In this Summer edition of the PayLessTax newsletter, we look at the following issues: MTD Compliance: Key deadlines for sole traders and landlords. Tips for a smooth transition to digital records. Trivial Benefits: What qualifies as tax-free perks for employees. Important limits for directors. VAT Invoice Tips: How to make sure your VAT invoices are…

Pay Less Tax – Spring 2024 Edition

In this Spring edition of the PayLessTax newsletter, we look at the following issues: The Child Benefit’s Nemesis: Learn about strategies to mitigate the high-income child benefit charge, including income evening, investments, and pension contributions. Property Incorporation Pitfalls: Discover the benefits and pitfalls of incorporating property portfolios, from tax implications to administrative costs. Deregister Dilemma:…

We’re Thrilled to Announce Katie Walton as the Latest Addition to Our Team in the Role of Accountant.

I joined Sibbalds in November 2023 as an Accountant. My role includes preparing Year End Accounts, Management Accounts and Bookkeeping for Small and Medium Sized companies. Qualifications and Experience I have recently completed my Level 4 AAT Qualification with EMA Training Ltd in Derby. Whilst completing my qualifications, I have had experience in both…

Pay Less Tax – Capital Gains Tax Special 2023

In this Capital Gains Tax edition of the PayLessTax newsletter, we look at the following issues: A Relief for Rollover – Rollover relief (RR)can potentially be claimed where a qualifying asset (old asset) used in the trade is disposed of resulting in a chargeable gain and the proceeds are deemed to be reinvested into another qualifying asset…

Pay Less Tax Autumn 2023

In this Autumn edition of the PayLessTax newsletter, we look at the following issues: The potential loss of state pension entitlement Gift holdover relief Deadline to claim backdated bereavement allowances; and 50% tax free bonus account for low earners Read the Newsletter

Pay Less Tax Spring 2023

In this Spring edition of the PayLessTax newsletter, we look at the following Mitigating Inheritance Tax with Freezer/Growth Property Strategy: Freezer/growth property inheritance strategy helps property investors mitigate inheritance tax by using a corporate vehicle to freeze their shares and grant growth shares to their children, allowing the increase in company value to fall…

A warm welcome to Shona Dundon who joins us as a Senior Accountant

I joined Sibbalds in December 2022 as part of the accounts preparation and bookkeeping department. Qualifications and Experience: I graduated from Derby University in 2015 with a BA (Hons) degree in Accountancy and Finance, after which I have proceeded to work in all areas of accounting firms, now focusing on Accounts, Corporation Tax, Personal…

Pay Less Tax Autumn 2022

Our latest Pay Less Tax newsletter is out now Points make penalties – A look at the new penalty regulations and deadlines for filing returns 150% Land Remediation Relief – If you are a UK company which has acquired a major interest in a brownfield site which is contaminated or derelict and you incur…

Pay Less Tax Newsletter Charity Special 2022

In this special edition of the PayLessTax newsletter we look at different ways we can improve the position for charities whilst mitigating the impact upon our pockets as well. A look at the Gift Aid Scheme Setting up a Payroll Giving Scheme The effect of charitable contributions on Inheritance Tax Planning Gifting assets such as…

Team Sibbalds go Go-Karting

Social Secretary and Senior Accountant, Rachel Hickie, recently organised a fantastic team away day. The team got together for an afternoon of Go-Karting at Motorsport, Nottingham. It seemed that a few individuals showed their competitive streak and were spotted bumping into each other or spinning out in the battle to overtake and attempt to reach…

Spring Statement Summary – E-News April 2022

The Chancellor of the Exchequer, Rishi Sunak, delivered his Spring Statement on Wednesday 23 March 2022. In this early edition of our April tax newsletter we outline the key measures affecting our clients.Our latest business and tax newsletter covers the following issues: National Insurance Contributions Income Tax Business Tax Relief for Capital Investment Fuel Duty Household Support…

Pay Less Tax Newsletter – Winter 2022

In this Winter edition of the PayLessTax newsletter, we look at the following issues: Electric Vehicle (EV) Grants We examine the grants available to help with the cost of installing EV chargepoints for homeowners and businesses Benefits of a Regular Pension Review A summary of the main issues you should be reviewing on an…

Declan Clare joins us as a Trainee Accountant

I joined Sibbalds auditing team at the start of 2022 with the ambition to assist in all aspects accounting and to qualify and become a Chartered Accountant. Qualifications and experience I originally started my finance career working in industry for an international loans company. I then moved to a practice in Nottingham where I…

Pay Less Tax Newsletter – Autumn 2021

In this Autumn edition of the PayLessTax newsletter, we look at the various ramifications behind child benefit, the possibilities conjured up by Freeports, the opportunities surrounding holiday lets and the new payment penalty regime which is coming into play from April 2022. https://buff.ly/3oZloYN Download the Pay Less Tax Newsletter

A warm welcome to Sanah Emran who joins our Bookmaker team

We’re delighted to welcome Sanah Emran to the Sibbalds team. Sanah has 8 years of bookkeeping experience working with Sage 50 accounts and Xero. More about Sanah

Read our 2021 October Budget Summary

Our summary focuses on the tax measures which may affect you, your family and your business. If you have any questions please contact us for advice. Many of the spending announcements had already been leaked to the Press prior to Budget Day and arguably a lot of it was not new money. The Chancellor…

We welcome Chris Ruscoe who joins us as a Payroll Manager

We’re delighted to welcome Chris Ruscoe to the Sibbalds team. Chris is a payroll professional with 20 years’ experience from small through to large corporate businesses. Chris’s role is to ensure that we perform to the highest standards and provide the very best service for each individual client, whatever their needs. More about Chris

Blog

Latest news and updates from Sibbalds